BursaMalaysia

KLCI ends firmer

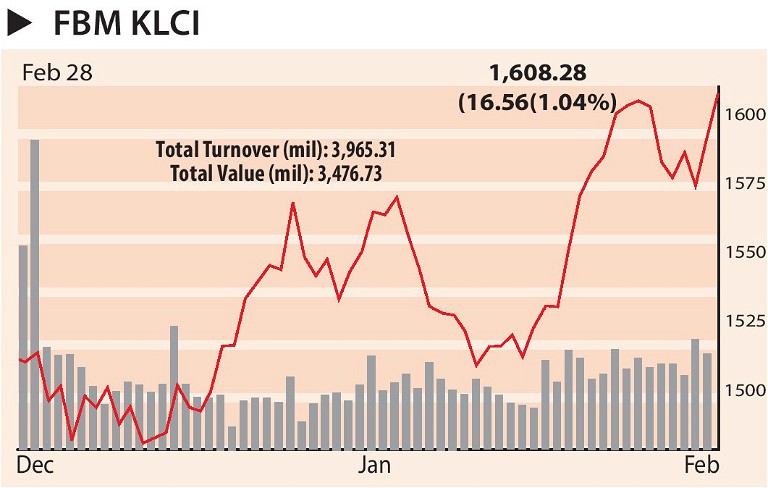

BURSA Malaysia closed firmer yesterday on persistent buying interest in blue chips as investors shrugged off the tensions between Russia and Ukraine, dealers said.

A dealer said investors had started to buy heavyweights following the announcement of positive corporate earnings recently.

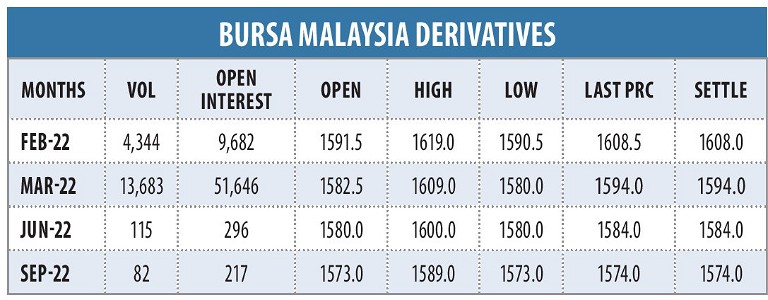

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) advanced 1.04% or 16.56 points to 1,608.28 from 1,591.72 last Friday’s close.

The barometer index, which opened 4.02 points higher at 1,595.74, its intraday low, hit an intraday high of 1,613.49 during the early session.

However, the overall market breadth was negative with losers surpassing gainers 635 to 413, while 368 counters were unchanged, 862 untraded and 51 others suspended.

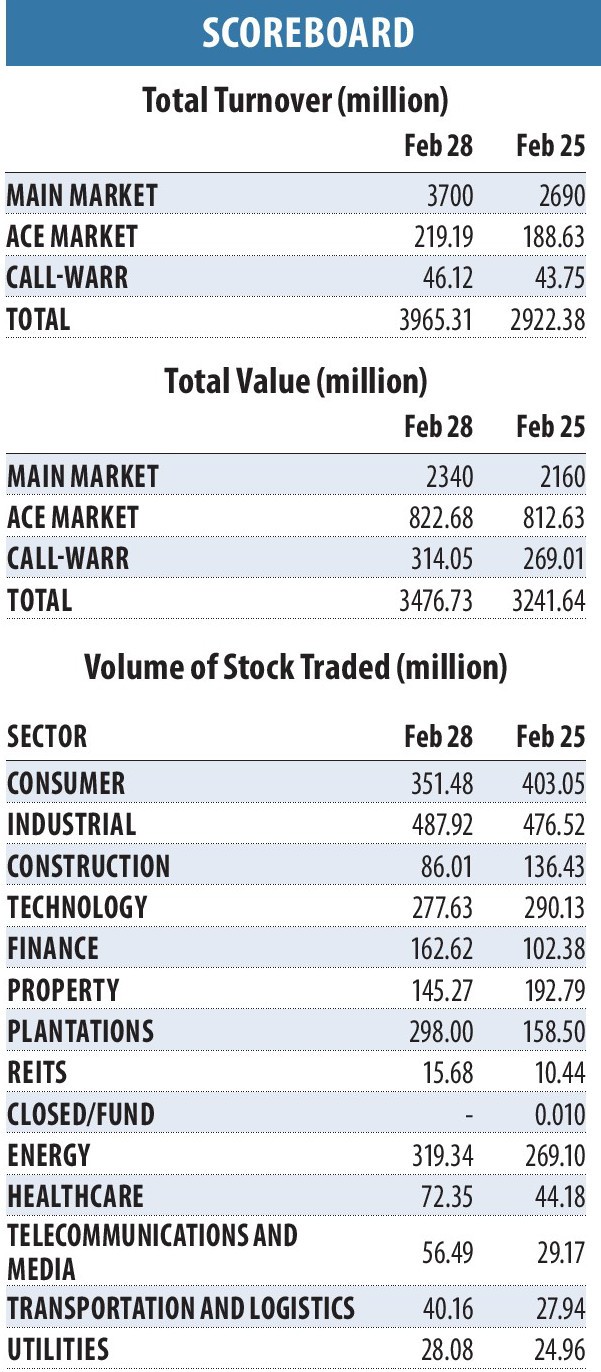

Total turnover rose marginally to 3.47 billion units worth RM3.97 billion against 3.24 billion units worth RM2.92 billion last Friday.

Rakuten Trade Sdn Bhd VP of equity research Thong Pak Leng said the news that Russia is prepared to send a delegation to Belarusian capital Minsk for talks with Ukraine had also provided a fillip to the positive sentiment.

On the domestic front, he said the FBM KLCI had broken the 1,600 technical resistance again and it might head towards the next resistance at around 1,618-1,620 level.

“We remain cautiously optimistic given the improvement in the local market sentiment and foreign support but investors should stay alert on the increasing market volatility and external uncertainties,” he told Bernama.

As such, he said the FBM KLCI was expected to move rangebound and hover at the 1,600-1,620 level for the week.

“Technically, the immediate resistance is unchanged at 1,618, while support is at 1,570,” he said.

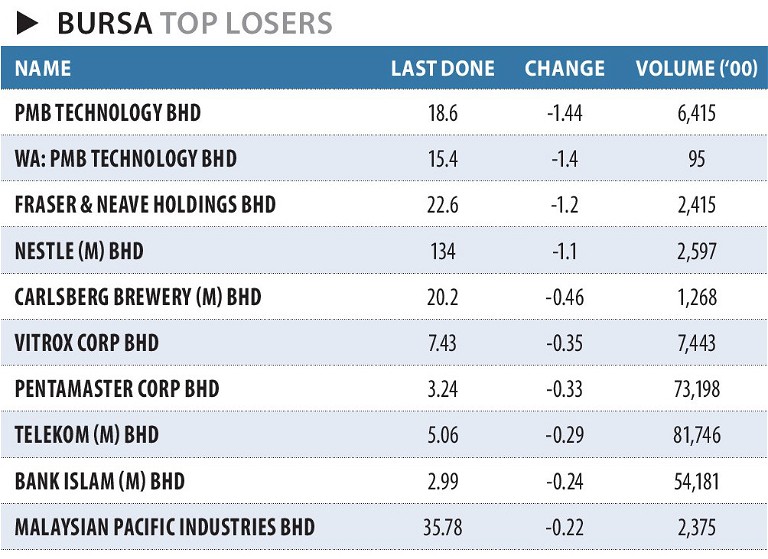

Heavyweights Malayan Banking Bhd fell 12 sen to RM8.76, Telekom Malaysia Bhd shrank 29 sen to RM5.06, Public Bank Bhd increased eight sen to RM4.45, MR DIY Group (M) Bhd dropped six sen to RM3.63, Sime Darby Bhd shed four sen to RM2.27 and Nestlé (M) Bhd slipped RM1.10 to RM134.

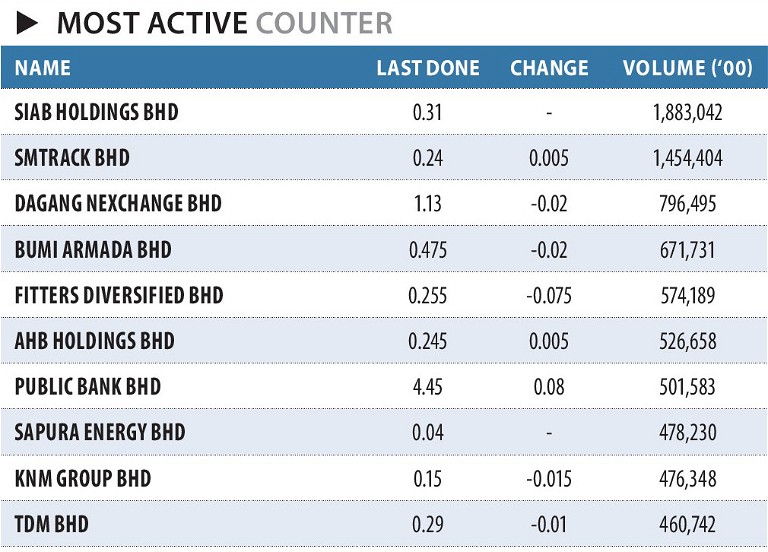

As for the actives, ACE Market debutant Siab Holdings Bhd added one sen to 31 sen, SMTrack Bhd gained half-asen to 24 sen, Dagang NeXchange Bhd and Bumi Armada Bhd eased two sen each to RM1.13 and 47.5 sen respectively, and Fitters Diversified Bhd declined 7.5 sen to 25.5 sen

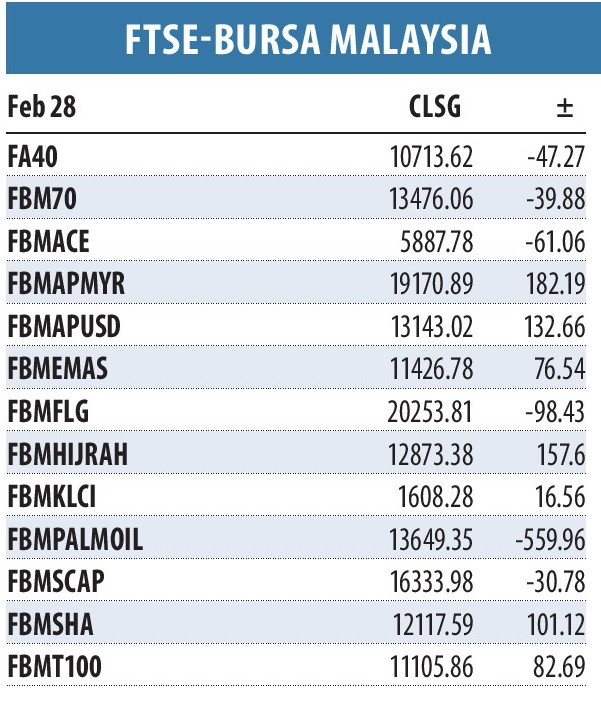

On the index board, the FBM ACE fell 61.06 points to 5,887.78, FBM 70 declined 39.88 points to 13,476.06, FBM Emas Index gained 76.54 points to 11,426.78, FBM T100 Index increased 82.69 points to 11,105.86 and the FBM Emas Shariah Index expanded 101.12 points to 12,117.59.

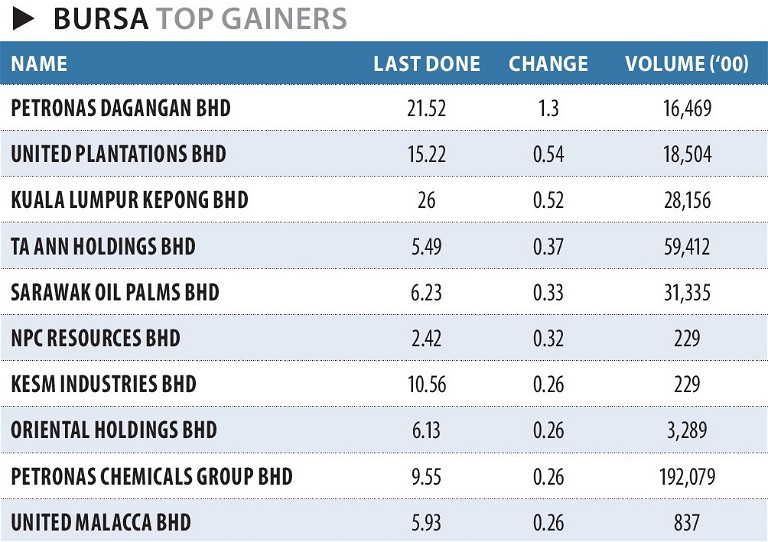

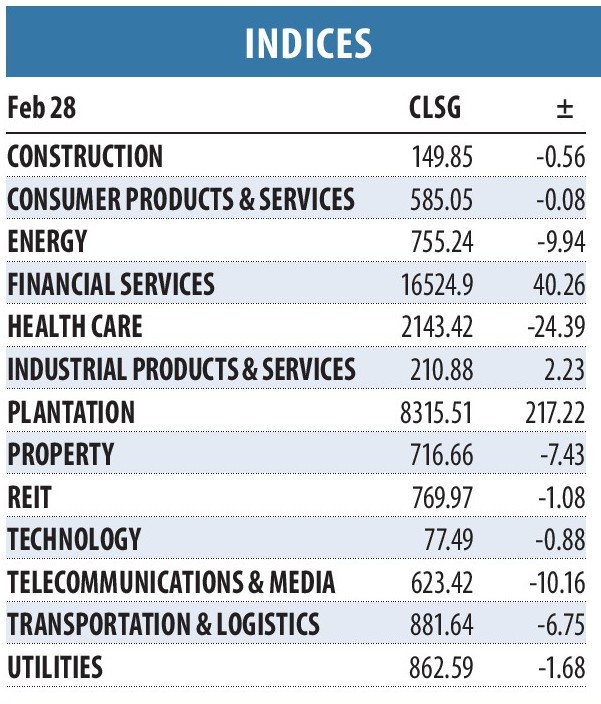

Sector-wise, the Financial Services Index put on 40.26 points to 16,524.9, the Industrial Products and Services Index was 2.23 points firmer at 210.88 and the Plantation Index climbed 217.22 points to 8,315.51.

The Main Market volume increased to 2.34 billion shares worth RM3.7 billion from 2.16 billion shares worth RM2.69 billion last Friday.

The ACE Market volume widened to 822.68 million shares valued at RM219.19 million versus 812.63 million shares valued at RM188.63 million previously.

Consumer products and services counters accounted for 351.48 million shares traded on the Main Market, industrial products and services (487.92 million), construction (86.01 million), technology (277.63 million), SPAC (nil), financial services (162.62 million), property (145.27 million), plantation (298 million), REITs (15.68 million), closed/fund (nil), energy (319.34 million), healthcare (72.35 million), telecommunications and media (56.49 million), transportation and logistics (40.16 million), and utilities (28.08 million).

— Bernama

RINGGIT TRENDS HIGHER AMID SOARING OIL PRICES

THE ringgit, supported by soaring oil prices as a result of the Russia-Ukraine conflict, strengthened further against US dollar yesterday. At 6pm, the local note stood at 4.1970/2015 versus the greenback compared to 4.2005/2040 last Friday’s close. Brent crude has risen above US$102 (RM428.25) per barrel amid worries over the crisis in Eastern Europe. Bank Islam Malaysia Bhd chief economist Dr Mohd Afzanizam Abdul Rashid said in overseas markets, the dollar continued to trend higher as market participants were seeking refuge against the heightened level of uncertainties. He said the US Dollar Index (DXY) continued to march higher to more than 97 points. “The weaker euro and British pound against the greenback were the main driver for a stronger DXY as concerns over the war in Ukraine continued to take centre stage,” he told Bernama. At the close, the ringgit was also traded higher against a basket of other major currencies. It gained versus the Singapore dollar to 3.0897/0934 from 3.1016/1044 at the close last Friday and appreciated vis-a-vis the British pound to 5.6139/6199 from 5.6177/6224. The local currency improved against the yen to 3.6319/6361 from 3.6422/6455 last Friday and increased versus the euro to 4.6922/6973 from 4.6966/7005 previously.

— Bernama