Home Lending

Mortgages and Home Equity Line of Credit (HELOC)

Whether you’re a first-time homebuyer, seeking a more affordable monthly payment or thinking about buying a second property, we make it simple to get the mortgage loan that fits your goals and your budget

With a wide range of mortgage products, we make choosing the right mortgage the easiest part of shopping for your new home.

FIXED-RATE MORTGAGE LOANS

This “traditional” type of loan maintains its original interest rate throughout the entire life of the loan. (Any change in monthly loan payments will be due to increases in other charges like insurance or taxes that naturally occur over time.)

A fi xed-rate mortgage loan may be a good choice if you want the security of knowing your interest rate will not change and how much your monthly mortgage loan payment will be.

Mortgage loans come in various loan terms. In determining the length of your loan, you may want to consider the total amount of interest you want to pay over the course of your loan. You will pay more interest on a longer fi xed-rate loan term, but you will have lower monthly payments. You can pay off a shorter-term loan quicker, but will have higher monthly payments.

The first option to consider is your ability to make higher monthly payments. If you can afford to pay more per month, you can reduce the number of months you have to pay, and choosing a shorter-term loan will save you thousands in interest charges.

Your second option is to decrease the total amount of interest you pay on a longer-term loan, so you don’t lock yourself into higher monthly payments, but pay a little extra each month toward the principal when you are able to do so.

ADJUSTABLE-RATE MORTGAGE LOANS

While the name almost says it all, there are certain things about Adjustable-Rate Mortgages (ARMs) that you should know.

1. The rates are lower.

This rate provides you with lower initial payments for increased purchasing power.

2. ARMs are different.

Our programs provide an initial fi xed rate with convenient terms before the rate adjusts at all. These options are best for those who want added payment stability and lower initial monthly expense.

3. They fit your changing needs.

First-time homebuyers no longer tend to stay in their “starter” home for more than fi ve or 10 years, and experienced homeowners often plan to pay off their mortgages long before the maturity dates.

An adjustable-rate mortgage may be a good choice if you want to maximize your buying power, keep your payments lower during the fi rst few years of your loan, plan to move or pay off your mortgage within the next 10 years or if you expect your income to increase signifi cantly in the coming years.

JUMBO LOANS

Need a loan that’s larger than conventional loan limits? Our jumbo loan rates may surprise you. Use the Loan Consultant (HomeLoAAns.org) to get quotes on current interest rates and closing costs. The free website offers added value:

• Pre-approval

• Faster response

• Locks in your rate

Visit us at AACreditUnion.org/ borrowing/home-loans for more information.

UNIQUE LOANS

If your needs don’t fit within the framework of more traditional loans, we have some options for you.

First-Time Homebuyer Program

This loan is a low-cost, low-rate loan for the first-time homebuyer who has not owned a home in the last two years.

Residential Investment Property Program

We offer mortgages on one-to four-family residential investment properties at competitive rates with a low down payment. Available on fixed rate or ARMs.

Second Home/Vacation Properties

A second home is a property that is located a reasonable distance from the borrower’s principal residence and which the borrower occupies for some portion of the year. The dwelling must be suitable for year-round occupancy. Also, the borrower must have exclusive control over the property.

VALUE-ADDED SERVICES

We offer a number of value-added services to help make your move easier. These services can make the most of your hard-earned money by giving you trusted advice, cash back and rewards.

Members On the Move

Use this no-cost program when you begin the homebuying process. Members On the Move gives you access to real estate reference materials, provides you with a personal consultant and even gives you cash back.*

Personal Consultants

Our consultants can guide you through each step of homebuying and/or selling. They act as your advocate throughout the process by assigning you a certified real estate agent who can provide you valuable information regarding neighborhoods, schools and more.

Real Estate Agents

Get recommendations from specially trained and certified real estate agents from select well-known firms.

Cash Back on Sales and/or Purchases

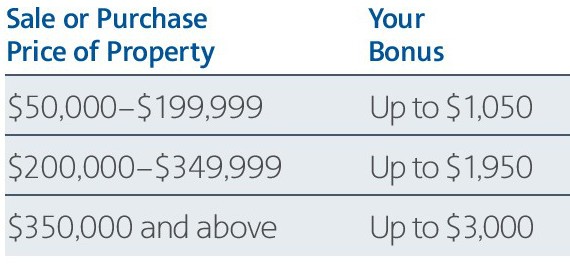

Get up to $3,000 cash back** based on the sale or purchase price of each transaction when you buy and/

or sell a home with our recommended agents. That means you can earn cash back on both transactions.

Cash Back Savings

Mortgage Connection Points Program

If you have an American Airlines Credit Union Visa® Platinum Rewards Credit Card, you can get up to 35,000

Connection Points† when you finance your home with American Airlines Credit Union.

FACT:

Remember that we

DON’T SELL

our mortgage loans to other lenders. We retain all servicing during the life of the loan.

* Members on the Move is provided by CARTUS. Cash back is not available in some states. All real estate commissions are negotiable. Contact a consultant for terms and conditions in order to confirm eligibility. ** $3,000 is based on an average purchase or sale price of more than $499,999.

†

The number of Connection Points awarded in conjunction with your new American Airlines Credit Union Mortgage Loan is 25,000 points for new mortgages to American Airlines Credit Union that are between $50,000 and $250,000 in loan principal amount for a first-lien mortgage. For loans greater than $250,000, an additional 10,000 Connection Points will be awarded. Offer valid for new mortgages at American Airlines Credit Union. Internal Home Equity Line of Credit Loans are not eligible. One award per funded loan. Prior to closing on your mortgage loan, you must have an open Consumer American Airlines Credit Union Visa®

Platinum Rewards Credit Card and be a member in good standing to receive Connection Points. American Airlines Credit Union Visa Platinum, Platinum Secured and all other credit cards and debit cards are not eligible for this offer. For Connection Points rules, please go to AACreditUnion.org/pdf/connectionpointsrules.pdf.

Allow 4 to 6 weeks after closing date for balance to appear on your “Connection Points Summary.” American Airlines Credit Union reserves the right to change or end the Mortgage Connection Points Program and its rules and conditions at any time without notice. Connection Points powered by CURewards®.

Visa is a registered trademark of Visa International Service Association.