Credit Cards

Our Visa® Platinum cards offer more choices, great rates and exclusive benefits.

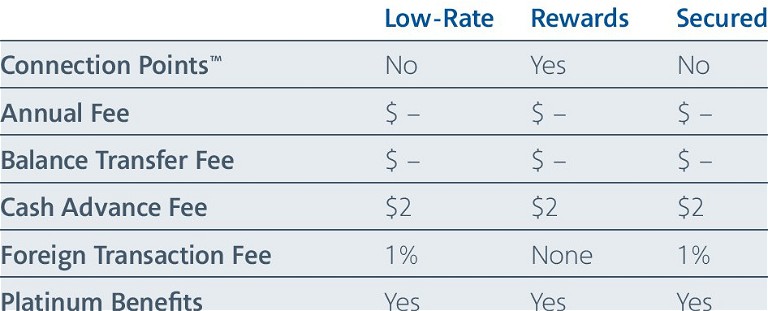

Compare the cards below to determine which one is best for you:

PLATINUM BENEFITS INCLUDE:

• Lower APR*

• Greater global protection and enhanced fraud protection with Chip-Enabled Technology

• Protection from fraudulent charges with Zero Fraud Liability**

• Travel with peace of mind knowing you have $500,000 in Travel Accident Insurance

• When renting a car, know you’re protected with Auto Rental Collision Insurance

• Travel and Emergency Assistance puts you in touch with the appropriate emergency services should the need arise

ONLINE SAFETY

Remember, American Airlines Federal Credit Union will never call and ask you to provide personal information such as your Social Security number or the three-digit CVV number on the back of your debit or credit card over the phone. If someone calls asking for personal data, even from a familiar number, this may be an act of “spoofing,” or someone disguising themselves as a trusted source in order to fool you into revealing your info.

* As of 1/1/2021, the current nonpromotional variable Annual Percentage Rate (APR) for purchases, balance transfers and cash advances is based on creditworthiness and ranges from: Visa Platinum: 7.00%–12.24%, Visa Platinum Rewards: 8.50%–14.24%, Visa Platinum Secured: 12.24%.

If you default under your card agreement with us, we may increase your APR to the fixed default APR which equals 18.00%. The APR will vary with the market based on the Prime Rate and is subject to change after the account is opened. Annual fee: $0. Balance transfer fee: $0.

Cash advance fee: $2. Minimum finance charge: $.50 except where prohibited by law. Foreign transaction fee: 1% of transaction amount after its conversion to U.S. dollars. There is no fee for the Rewards card. Connection Points powered by CURewards®. ** Zero Liability Policy does not apply to ATM transactions, to PIN transactions not processed by Visa, or if you were negligent or fraudulent in the handling of your card, including failure to report loss or fraud in a timely manner.

†

Must have the American Airlines Credit Union Visa Platinum Rewards Credit Card or Platinum Starter Card to earn Connection Points on Debit Card purchases — valid only on Flagship Checking accounts.

Visa is a registered trademark of Visa International Service Association.

STILL CAN’T DECIDE WHICH CARD TO GET? LET US HELP YOU.

Platinum Low-Rate Credit Card

Pay off your balance quickly with a very low interest rate.

Platinum Rewards Credit Card

Earn big rewards and get more for every dollar you spend:

• Earn one (1) Connection Point for each dollar ($1) spent in purchases.

• Earn one (1) Connection Point for every three dollars ($3) spent in purchases with your Visa Debit Card† † .

• Redeem Connection Points for rewards like gift cards, cruises, hotel stays, air travel and brand-name merchandise.

Platinum Secured Credit Card

This card can help build or rebuild your credit history. Secure funds in an interest-bearing American Airlines Credit Union savings account to enjoy the convenience of a credit card.

FACT:

Our members spent more than

$15 million

in international debit and credit card purchases last year.